本文目录导读:

- 债务重组的会计处理

- 债务重组的会计确认

- 债务重组的会计披露

- Debt Restructuring Accounting Standards

- Accounting Treatment of Debt Restructuring

- Accounting Recognition of Debt Restructuring

- Accounting Disclosure of Debt Restructuring

债务重组是指债务人与债权人之间对债务进行重新安排的过程,在企业运营过程中,由于各种原因,企业可能会出现偿债困难的情况,此时债务重组可以为企业提供一种解决办法,债务重组的会计准则是指在进行债务重组时,企业需要遵循的会计原则和规定。

债务重组的会计准则主要包括以下几个方面:

(图片来源网络,侵删)

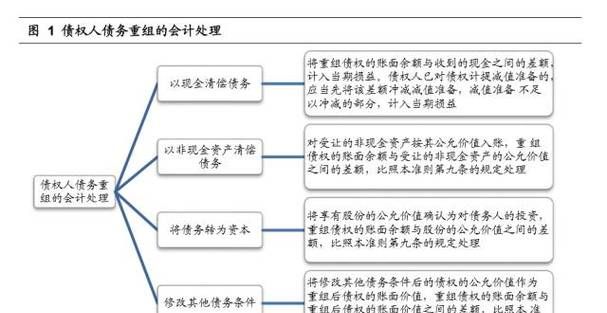

1. 债务重组的会计处理

在进行债务重组时,企业需要按照会计准则对债务进行相应的处理,根据国际会计准则(IAS)第39号准则,债务重组可以被视为债务重组的会计处理,根据该准则,企业需要将债务重组后的债务重新计量,并将其确认为债务的解决。

2. 债务重组的会计确认

债务重组的会计确认是指企业在债务重组过程中,根据会计准则对债务的确认和计量,根据国际财务报告准则(IFRS)第9号准则,债务重组后的债务应该被确认为负债,企业需要根据债务重组协议的具体条款,对债务进行重新计量,并将其确认为负债。

3. 债务重组的会计披露

债务重组的会计披露是指企业在财务报表中对债务重组情况进行披露的过程,根据国际财务报告准则(IFRS)第7号准则,企业需要在财务报表中披露债务重组的主要信息,包括债务重组的类型、债务重组的影响等。

Debt Restructuring Accounting Standards

Debt restructuring refers to the process of rearranging debt between a debtor and its creditors. In the course of business operations, companies may face difficulties in meeting their debt obligations. Debt restructuring provides a solution for companies in such situations. Debt restructuring accounting standards refer to the accounting principles and regulations that companies need to follow when undergoing debt restructuring.

The debt restructuring accounting standards primarily include the following aspects:

1. Accounting Treatment of Debt Restructuring

During debt restructuring, companies need to apply accounting standards for the appropriate treatment of debt. According to International Accounting Standard (IAS) 39, debt restructuring can be accounted for as debt restructuring. Under this standard, companies are required to re-measure the debt after restructuring and recognize it as the settlement of debt.

2. Accounting Recognition of Debt Restructuring

Accounting recognition of debt restructuring refers to the recognition and measurement of debt by companies during the debt restructuring process, based on accounting standards. According to International Financial Reporting Standard (IFRS) 9, the restructured debt should be recognized as a liability. Companies need to re-measure the debt based on the specific terms of the debt restructuring agreement and recognize it as a liability.

3. Accounting Disclosure of Debt Restructuring

Accounting disclosure of debt restructuring refers to the process of disclosing the debt restructuring information in the financial statements. According to International Financial Reporting Standard (IFRS) 7, companies are required to disclose the key information related to debt restructuring in the financial statements, including the type of debt restructuring and its impact.

Overall, debt restructuring accounting standards provide guidelines for companies to properly account for and disclose debt restructuring activities. By following these standards, companies can ensure transparency and accuracy in their financial reporting.

火焰鸟金融( dk.yizhandaikuan.com )以高效、简易和专业的金融服务服务企业、个人客户以及银行合作伙伴,提供公积金贷款申请、房贷办理、金融规划及理财服务等一系列针对不同金融需求的综合性解决方案。

扫描二维码推送至手机访问。

以上信息来自于互联网,目的在于传递更多信息,并不代表本网赞同其观点。其内容真实性、完整性不作任何保证或承诺。如若本网有任何内容侵犯您的权益,请及时联系我们,本站将会在24小时内处理完毕。